Testamentary trusts offer a variety of benefits to both testators and beneficiaries, including asset protection, tax advantages, and the ability to control how and when assets are distributed. By working with an experienced testamentary trust lawyer, you can ensure that your estate plan meets your specific needs and goals.

What are Testamentary Trusts?

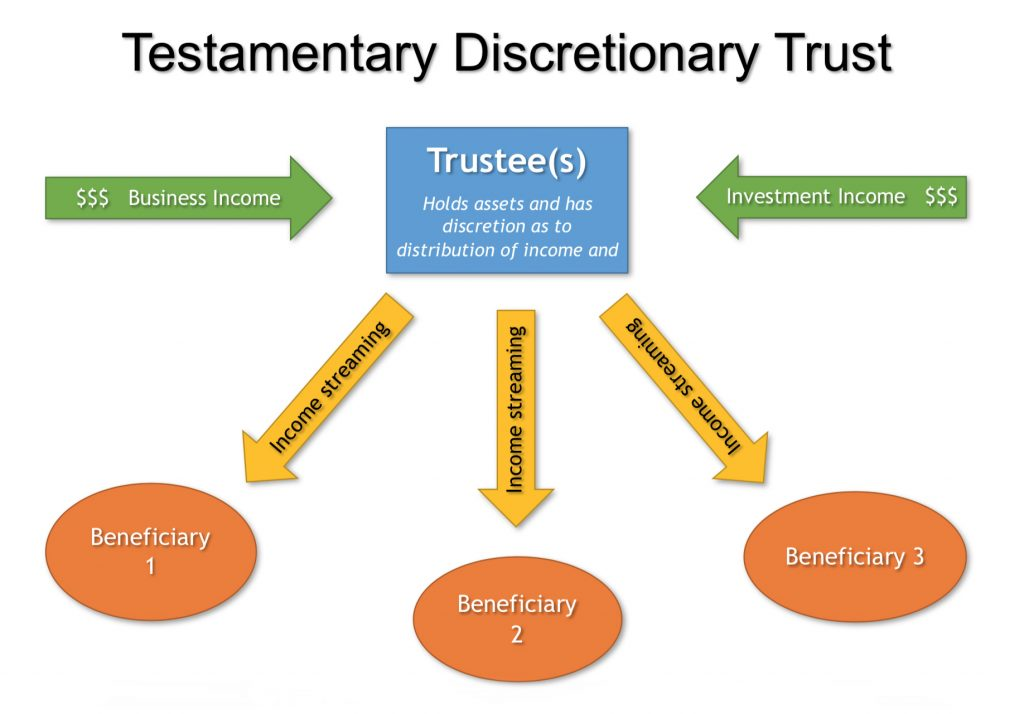

A testamentary trust is established in a will and comes into effect upon the testator’s death. Unlike inter vivos trusts, which are established during the settlor’s lifetime, testamentary trusts are created by the testator. They can be modified or revoked at any time before death.

Testamentary trusts are typically used to protect assets and provide for the needs of beneficiaries. The terms of the trust can be tailored to meet each beneficiary’s specific needs, including the ability to delay distributions, impose spending limits, or restrict the use of trust assets.

Benefits of Testamentary Trusts

There are several benefits to including a testamentary trust in your estate plan, including:

Asset Protection: By placing assets in a trust, you can protect them from potential creditors or legal claims. This can be particularly important if you have beneficiaries who are minors, have disabilities, or maybe at risk of being sued.

Tax Advantages: Testamentary trusts can offer tax advantages by reducing estate taxes, income taxes, and capital gains taxes. By setting up a trust, you can take advantage of tax exemptions and deductions that may not be available if assets are distributed directly to beneficiaries.

Control: With a testamentary trust, you can control how and when assets are distributed to beneficiaries. This can be particularly important if you have beneficiaries who are minors, have disabilities, or have a history of financial mismanagement.

Privacy: Unlike the probate process, which is a matter of public record, the terms of a testamentary trust are private. This can be an essential consideration if you value your privacy or want to avoid public scrutiny of your estate plan.

Flexibility: Testamentary trusts can be tailored to meet each beneficiary’s needs. For example, if you set up a trust for a minor beneficiary that delays distributions until they reach a certain age or milestone, such as graduation from college. You can also impose spending limits or restrict the use of trust assets to ensure that they are used for specific purposes, such as education or medical expenses.

Working with a Testamentary Trust Lawyer

Working with a testamentary trust lawyer is essential if you consider including a testamentary trust in your estate plan. A lawyer can help you understand the benefits and limitations of testamentary trusts and can assist you in drafting a trust that meets your specific needs and goals.

When choosing a testamentary trust lawyer, it is essential to look for someone with experience in estate planning and trust administration. It will help if you consult a lawyer familiar with the laws and regulations governing trusts in your state, as these can vary significantly from state to state.

Conclusion

Including a testamentary trust lawyer in your estate plan can offer various benefits, including asset protection, tax advantages, and control over how and when assets are distributed to beneficiaries. By carefully planning your estate and including a testamentary trust, you can ensure that your assets are protected and your beneficiaries are provided for following your wishes.